10 most common payroll process errors and how to avoid them

Correct pay is one of the most basic expectations an employee should have of their employer.

Correcting payroll process errors takes time and can be incredibly unsettling for employees whether they are underpaid and fall short or overpaid and must return money, which might already have been spent, to the company.

As recent news headlines in several countries revealed, without the right tools and resources, employee payroll can be incredibly complex and, if not well managed, results in an array of errors that can cost employees, and the business, time and money.

The 10 most common payroll process errors that should be avoided

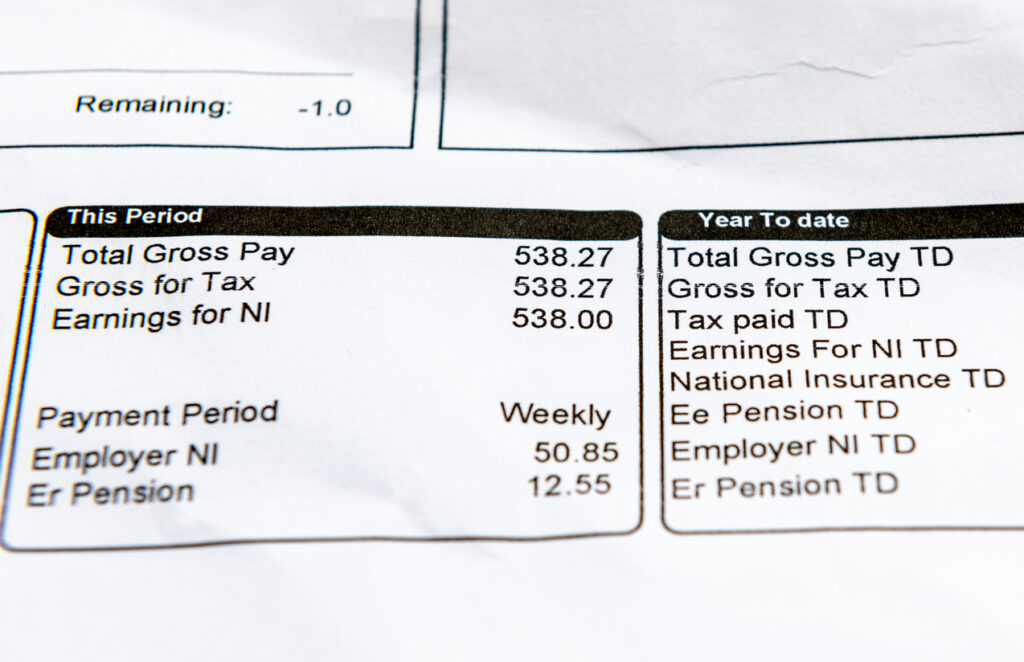

1. Miscalculating pay

Registering contracted employees as “independent contractors” removed core rights and protections including:

- Minimum wage

- Overtime pay rates

- Social Security contributions

- Right to collective bargaining

- Workers’ compensation

- Unemployment compensation

- Protection from wage discrimination

A recent study by NELP estimates that 10 to 30 percent of employers in the United States may be misclassifying their workers, resulting in billions in lost taxes for U.S. tax authorities.

2. Misclassifying employees and contractors

Registering contracted employees as “independent contractors” removed core rights and protections including:

- Minimum wage

- Overtime pay rates

- Social Security contributions

- Right to collective bargaining

- Workers’ compensation

- Unemployment compensation

- Protection from wage discrimination

3. Miscalculation or failing to pay overtime

Incorrectly logged overtime hours result in wrong pay, which can lead to the need for corrections spanning multiple tax years.

Overtime payment errors can arise in any of the following scenarios:

- Work during break times

- Time traveling between worksites

- Participation in activities outside of normal hours; for example, training, team building or company parties

4. Failure to report all taxable compensation

Employee pay comprises more than salary, overtime, commissions or bonuses. Additional taxable earnings include:

- Equity compensation

- Bonus awards

- Private medical insurance

- Employee rewards, e.g., gift cards, gym membership or travel awards

- Company car or allowance

5. Relying on the payroll system and not the quality of data

Any payroll process – whether manual, cloud or fully managed – is only as good as the quality of the data input and skills of the people responsible for the payroll run. Data in equals paychecks out.

6. Inadequate payroll skills and backup

There needs to be more than one person capable of both understanding and handling the payroll functions.

These should be skilled in payroll and understand compliance procedures, including tax regulations and legal requirements for payroll in their region – many of which are updated regularly.

In addition, if the computer is down for any reason, a manual backup system is required for handling all payroll functions

7. Missing reporting deadlines

This is one of the most common payroll mistakes and is easily done. Late filing of taxes incurs a penalty.

8. Using wrong tax code

Keeping on top of tax codes is crucial to ensure employees are paid correctly and the right amount of tax is collected by the tax authority. Tax codes adjust with personal circumstances, for example:

- New starters

- Company benefits such as a car or private medical insurance

- Furloughed employees

- Remote working

- Hybrid working

9. Poor record keeping and data entry

Data entry mistakes, including mismatching employee to social security number, poor logging of time and attendance.

10. Mismanagement of garnishments, levies or child support

Monies owed by court order can be deducted from pay and whoever is handling payroll is responsible for sending the payment to the appropriate recipient. Failure for funds to reach the recipient can constitute a breach.

What should you do if you over- or underpay an employee?

Be honest, open and clear of the steps to resolution.

Employee wellbeing [/thought-leadership/2022-alight-international-workforce-and-wellbeing] is more than pay. It’s about feeling in control and secure, knowing you can pay the bills, can deal with unexpected costs, and provide for a healthy financial future, while able to make choices that allow you to enjoy life.

Payroll errors do happen and when they do, there is a legal and moral responsibility to correct them rapidly. The time to resolution varies per country, and employees backed by unions or work councils have the power of these to support them.

Steps to remedying payroll process errors

- Establish what the pay discrepancy is, and over what period

- Contact the employee and outline the error

- Understand what financial challenges this might present to the employee

- Advise on steps to resolution – especially in the case of overpayment where the employee is going to carry a financial burden

- Arrange a payment program, if possible

Payroll audits

A regular payroll audit, with a specialist payroll partner, should be part of any payroll process, whether payroll is run in-house, managed as a service or outsourced. It is too fundamental to allow to go wrong.

As part of the audit, a specialist should look at everything from your technology, systems and codes through to your payroll team to ensure you have the correct skills in place.

With the nature of work and pay ever-changing, along with fast changes in technology, a regular payroll audit will provide recommendations on where to improve and how to avoid future issues.

* Please note, there is never a one-size-fits all for payroll and this includes compliance, the correction of pay errors and the reporting of such events. It is worth reviewing the Global Payroll Complexity Index to get a better understanding of the challenges payroll professionals face.