Article

Lessons from Strada’s 2025 global payroll complexity index

Payroll complexity isn’t going away.

As Strada’s 2025 Global Payroll Complexity Index reveals, while global payroll complexity shows signs of stabilizing, that only confirms its staying power. Although many businesses might be looking for ways to eliminate complexity from their payroll operations altogether, the most effective organizations are following a different approach.

What are the drivers of global payroll complexity?

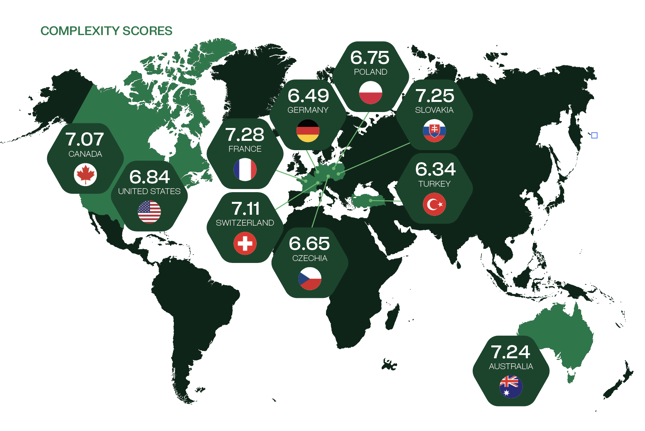

Payroll complexity is shaped by different factors depending on the country. Tax regulations, social security plans, and reporting requirements are significant contributors. Countries that saw major complexity upswings in this year’s top 10 ranking were impacted by increased mandatory deductions, shifting data protection rules and time-tracking requirements.

Our infographic linked below provides a cross-section of our top 10 ranking, revealing some of the country-specific rules and requirements determining their complexity level. Get the full infographic here

However, understanding the causes of complexity is not enough for businesses looking to successfully navigate the global payroll landscape. Which is why the 2025 GPCI also explores the opportunities it presents and shows how business leaders can stay a step ahead by turning these opportunities to their advantage.

Embracing a new view of complexity the 3 components to harmonize payroll

It's not as easy as just implementing new technologies or introducing new training initiatives. As the 2025 GPCI makes clear, taking advantage of complexity demands a mindset shift. Changing the way complexity, and even payroll as a whole, are viewed. This involves striking a balance that perfectly harmonizes:

- Digital technology

- Payroll expertise

- Payroll data

The same systems that run payroll can clarify payroll, providing capabilities and insights that can help companies work smarter—supercharging productivity, boosting workforce engagement, reducing risk and ensuring peak performance.

Using greater digital technology to decrease complexity

Most organizations operate payroll in hybrid work environments—a makeshift mix of platforms and spreadsheets—and many are still dependent on manual processes. In today’s fast-moving business landscape, it’s easy to understand why some companies might be intimidated by the idea of undertaking an end-to-end digital transformation.

However, while payroll complexity results from the interplay of numerous external factors—tax regulations, social security systems, reporting requirements, and legislative change—the 2025 GPCI highlights a notable trend: Where complexity has decreased, it’s often due to greater digitization.

Furthermore, the increasing stabilization and standardization of payroll complexity across the globe has created the perfect conditions for large-scale automation and AI adoption.

It’s no surprise that automated cloud-based systems and AI technology can dramatically reduce the administrative burdens of payroll processing. They eliminate the need for time-consuming, manual tasks, improve efficiency, increase accuracy, and help ensure compliance.

What’s also becoming clear is that cloud-native systems with AI capability can provide businesses with sharper insights into their operations. These systems aren’t just a platform for processing and record keeping. They reveal trends, model scenarios, create reports and answer questions. This enables businesses to not only streamline and simplify their payroll operations, but to see them in their full context.

Digital technology has turned payroll into a tool for smarter decision-making.

Payroll expertise in collaboration with cloud and AI solutions to manage complexity

While the latest cloud and AI technology is unmatched when it comes to automation, integration, and error reduction, even the most advanced technology is not enough to tackle complexity on its own.

Human expertise is essential.

The 2025 GPCI emphasizes the importance of pairing technology with payroll experts who can not only interpret complex laws and regulations but understand their implications and anticipate their impact.

Advanced technologies can process data at unbelievably high speeds with incredible accuracy. They can even offer strategic insights. But without payroll professionals to interpret these insights, translate them into action, and adapt operations accordingly, the gains afforded by digitization fall short of their potential.

Harnessing payroll complexity to work smarter can’t be accomplished with a simple platform upgrade. It’s the combination of modern technology and human expertise that provides businesses with the foresight and agility to stay a step ahead.

Payroll data for seeing through complexity and developing a holistic strategic vision

Perhaps most importantly, cutting through complexity involves changing the way businesses view their payroll operations. Long viewed as a back-office, purely operational process, the 2025 GPCI makes clear that the time has come for payroll to come front-and-center.

Payroll data is vital to navigating complexity.

Seeing through payroll complexity means the ability to connect regulatory obligations, operational processes and data to develop a holistic, strategic vision of your entire organization—its resources, its possibilities, its path forward.

Payroll data can deliver critical insights that directly inform C-suite strategies. For all its burdens, payroll complexity channels data that businesses can leverage to address everything from organizational resilience, to cost control, to talent management. It can even inform major decisions surrounding investment options and risk reduction.

Connecting payroll data with other workforce and financial data, and viewing that data through a lens of possibility, transforms it into something truly strategic. But these insights can only be harnessed when businesses make the shift towards understanding payroll complexity rather than avoiding it.

Striking a balance between all 3 components to navigate payroll complexity

Each of these components—digital technology, expertise, and payroll data—can help companies navigate payroll complexity. But what should be clear is that, for them to truly optimize their operations and drive value, they need to harmonize.

It takes a modern cloud-based, AI-equipped payroll platform to deliver the data and insights businesses need to take advantage of complexity. But understanding and interpreting that data, and using it to adapt operations, requires the kind of payroll expertise that only a human can offer.

Making payroll complexity work for you means all of these components need to work together.

The 2025 GPCI makes it clear: Now is the time for businesses to take action, change their thinking, and transform their payroll operations into a strategic powerhouse. Payroll complexity may not be going anywhere, but looked at through a lens of possibility, it can give businesses the clarity to see all the opportunities available to them, and leverage those strategic insights to work smarter, gain a competitive edge and unlock tomorrow.

Interested in learning more about harnessing the strategic potential of your payroll operations? We’re here to help. Contact Strada today.