Article

What’s driving US payroll complexity?

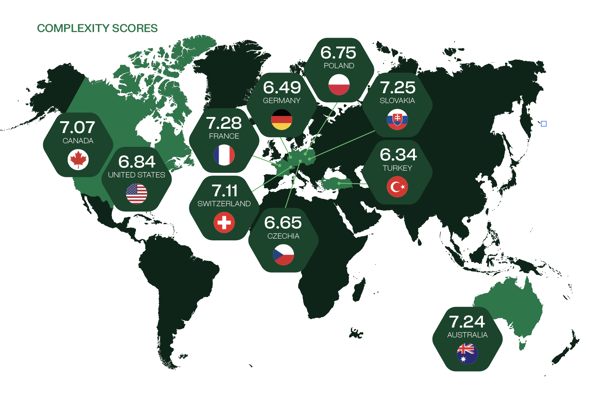

One of the big surprises in Strada’s 2025 Global Payroll Complexity Index (GPCI) was the US surging upward to join Canada in our top 10 ranking of the most complex countries for payroll processing—a 17% jump from the 2023 ranking—making North America the most complex region in the world. See the full infographic for a breakdown on complexity here

This unexpected shift was part of what motivated the launch of this year’s GPCI North America Spotlight, which explores what’s behind the rise of payroll complexity in North America, with a special focus on the US and its changing payroll landscape. The 2025 GPCI North America Spotlight traces the sharp rise in US payroll complexity to four major factors:

- Multi-state payroll frameworks

- The payroll knowledge gap

- Cross border expansion

- Uncertainty and change in pay and benefits

By examining these factors and how they impact payroll processing, US organizations can gain insights to help them take strategic advantage of these latest developments.

Multi-state payroll frameworks

Unlike most European and Asian countries, the US is a federal state. Where unitary states have nationwide rules governing tax, wages and compliance, in the US, these rules vary from state to state. This adds up to 51 unique payroll structures (including the District of Columbia) nationwide.

As you might imagine, for businesses operating in multiple states, payroll complexity can increase dramatically. When each state in which you operate has its own distinctive tax structure, wage laws and compliance obligations, attention to detail becomes crucial. Even the smallest error can result in significant consequences.

Fortunately, it is possible to navigate this landscape smoothly.

Advances in technology have allowed for the creation and implementation of robotic processes, like those used by Strada, that can monitor regulatory updates and legislative changes in real-time. Coupling this technology with payroll expertise allows businesses to cut through complexity, reducing risk while also streamlining their operations.

Payroll knowledge gap

Another driver contributing to the rise in US payroll complexity is the growing payroll knowledge gap.

In the US, the average age of a payroll manager is 48 years old. This means that most of the payroll experts working across the country learned their skills before digital technology revolutionized payroll processing. These payroll managers don’t just know how to run payroll—they understand the system.

However, as these experts reach retirement age, businesses are losing that deeper understanding and hands-on expertise, with 72% of US organizations reporting a payroll talent shortage.

While the latest technology works wonders when it comes to simplifying payroll processing, Strada has always emphasized the importance of coupling that technology with human insight. Striking the right balance between automation and expertise is crucial.

This is why Strada insists on taking a people-centric approach, developing payroll professionals for the next generation through structured knowledge capture and graduate programs. Similarly, our delivery models are designed to ensure continuity of knowledge, sharing our real-world payroll experience with our customers to keep vital skills from getting lost.

The goal of technology is to reduce human effort, not replace it entirely. Even as our systems seem increasingly capably of operating without our involvement, human guidance and oversight will always be essential for seeing through complexity.

Cross border expansion

Just as operating in different US states, each with individual rules and regulations, impacts payroll complexity, expanding into different territories brings its own challenges. Even neighboring territories like Canada and Mexico have entirely different payroll environments.

It’s not just a matter of accuracy and compliance. The difference in tax structures, social security programs and benefits systems can complicate forecasting and modelling. The true cost of hiring, budgeting or compliance decisions may not become clear until these differences are fully calculated and understood.

But expansion will always be a priority for US organizations and payroll complexity doesn’t need to be an obstacle to growth.

One of the purposes of Strada’s GPCI is to provide businesses with a clearer view of the global payroll landscape. Our national ranking lets companies know exactly where countries stand in terms of their complexity levels and examines what’s driving that complexity—from Canada’s bilingual reporting requirements and multiple mandatory deductions to Mexico’s mix of state-level tax and social security frameworks. A better understanding of the landscape enables compliance and confident growth,

Similarly, Strada’s unified delivery model combines global scale with local knowledge, providing real-time compliance monitoring and regulatory tracking to counter complexity and provide business with a clearer view of their labor costs in different territories.

Global payroll may be complex, but sustainable growth doesn’t have to be.

Uncertainty and change in pay and benefits

Finally, complexity in the US is being elevated by rapid regulatory change as federal and state administrations are routinely introducing legislation that directly impacts tax and employment.

This rapid change can make businesses—especially payroll teams—dizzy, as many of these new updates are finely-detailed and include retroactive adjustments, creating the sense that compliance goalposts are constantly shifting. As businesses struggle to keep up, they are vulnerable to increased errors and penalties.

Once again, striking the right balance of technology and human insight is key.

Integrated systems with real-time legislative tracking and scenario-planning tools can help businesses get the jump on these rapid-fire changes. Putting these tools in expert hands allows companies to model possible outcomes and adapt operations before changes take effect, ensuring they stay ahead of the curve.

This visibility can also be extended to employees, allowing them to see for themselves how these changes will directly impact their payslips. By enabling them to plan ahead and manage their money accordingly, this clarity reduces stress, minimizes potential misunderstandings and supports their overall well-being.

Even in a state of constant flux, it’s possible to keep your payroll consistently accurate and on-time.

From complexity to possibility

Payroll complexity is hitting unprecedented levels in the US. Legislative diversity, multi-jurisdictional taxation and a diminishing pool of experienced payroll experts have made North America one of the most demanding payroll regions in the world.

Whether the country will maintain its ranking or see more unpredictable rises or drops in the coming years is impossible to say. But one thing is clear: US businesses looking to navigate this complex landscape and stay competitive need to change the way they look at their payroll operations.

Seeing payroll as a living system and understanding the drivers of complexity is the first step towards transforming payroll operations from a compensation and compliance driven task to an agile source of insight, strategy, and growth. And the right combination of advanced digital technology and human expertise can help turn payroll complexity into possibility, enabling US businesses to work smarter, improve their employee experience, and unlock the future.